Tax Payment

Empowering Businesses With Easy Tax Payments

Our tax payment system helps businesses complete essential dues easily by connecting financial activity with structured processes that support organized submissions across required government-related workflows.

Guided Tax Processing: Follow a structured flow helping businesses enter details, review information, and complete necessary tax submissions.

Organized Payment Records: Access structured summaries helping businesses track completed payments, reference activity, and maintain clarity across obligations.

Your Route To Streamlined Tax Payments

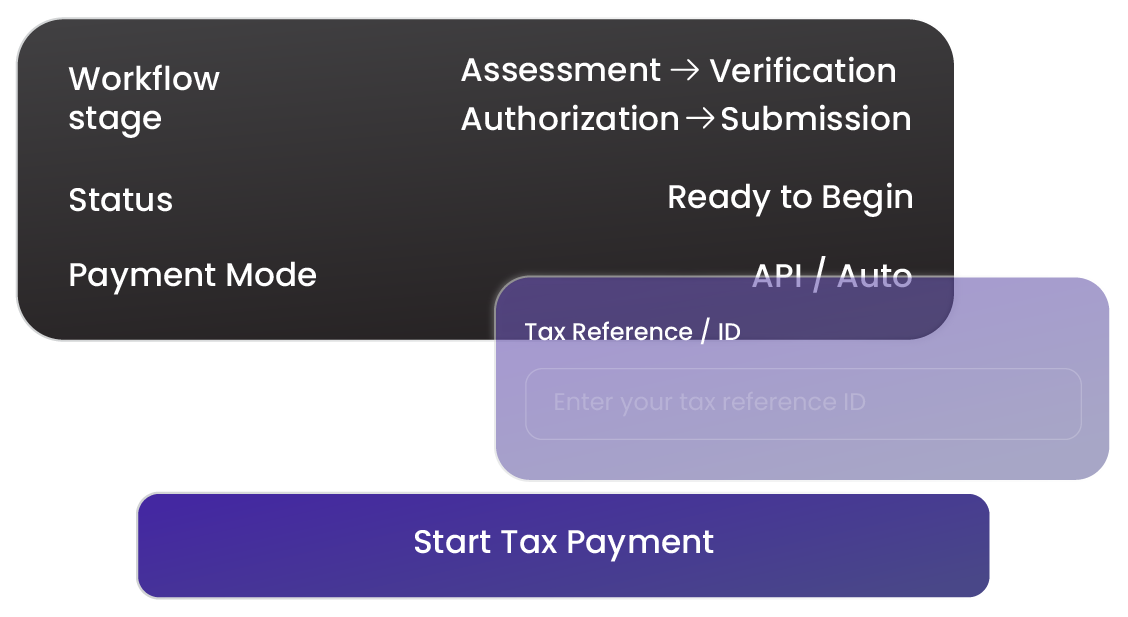

Our structured process guides stages clearly, helping you understand, authorize, and complete essential tax payments confidently through a streamlined system.

Collect tax details, validate accuracy instantly, ensuring submissions start with reliable information for smooth completion.

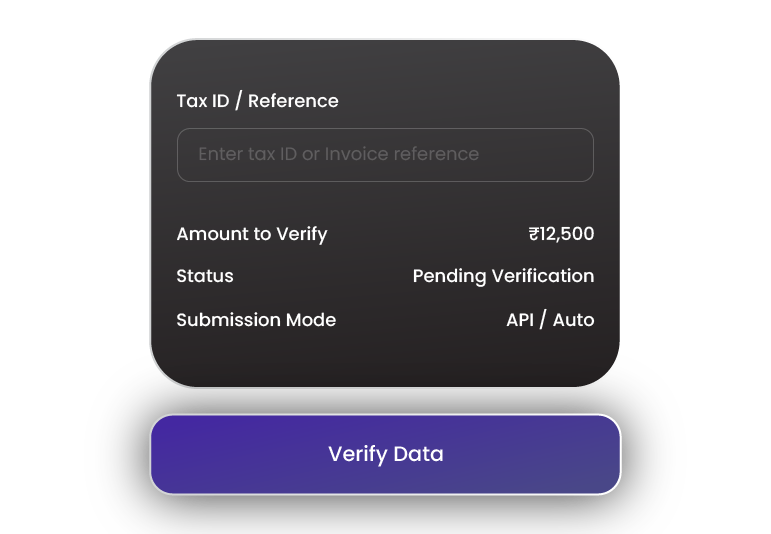

Review payable amounts, confirm credentials, and authorize each tax transaction securely through simplified approval process.

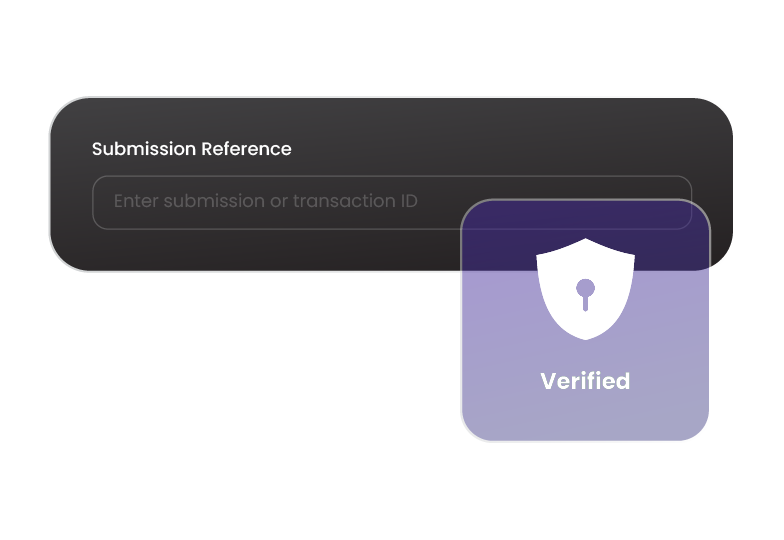

Authorized tax payments are processed, recorded, and routed correctly, ensuring completion across essential workflows.

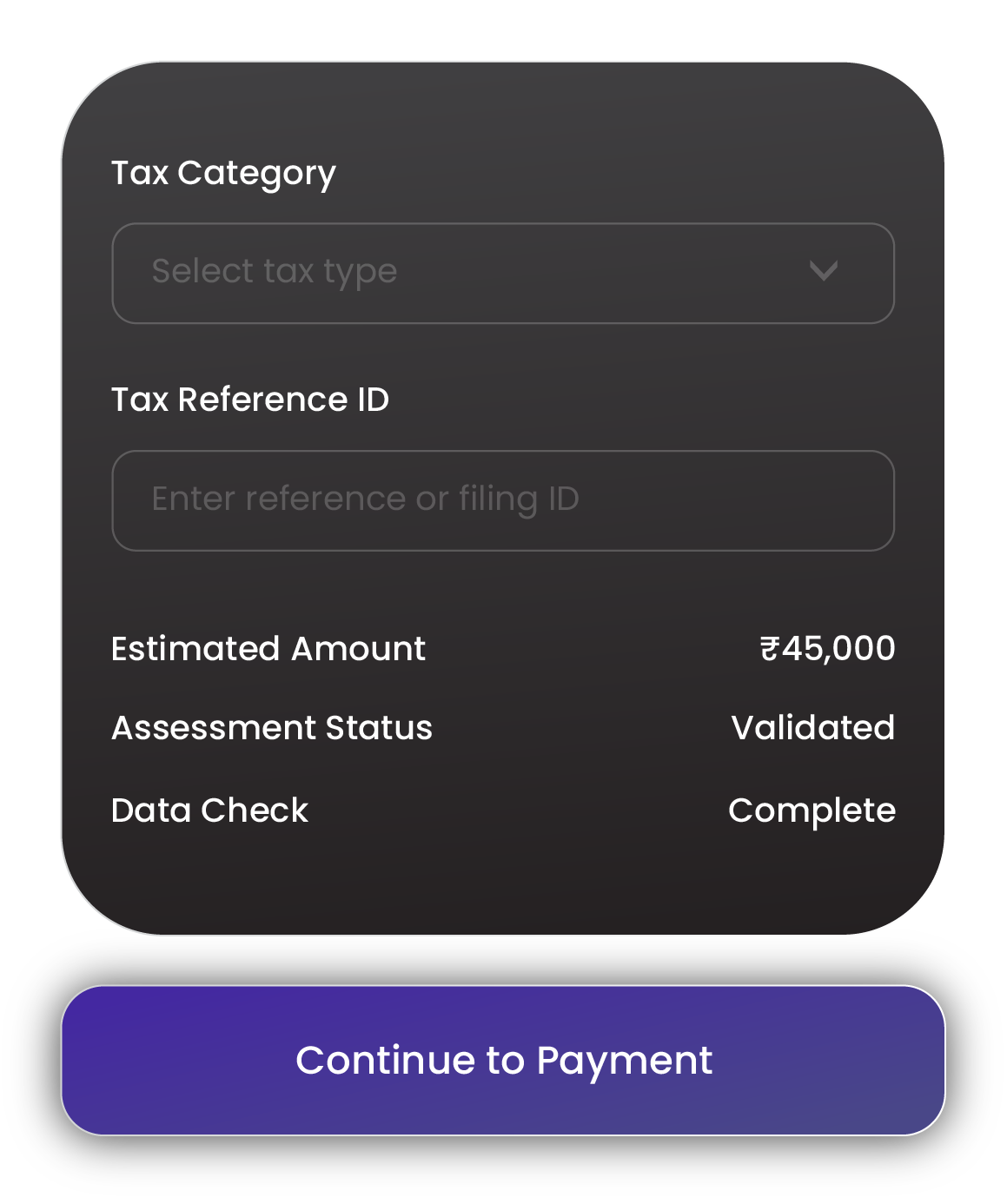

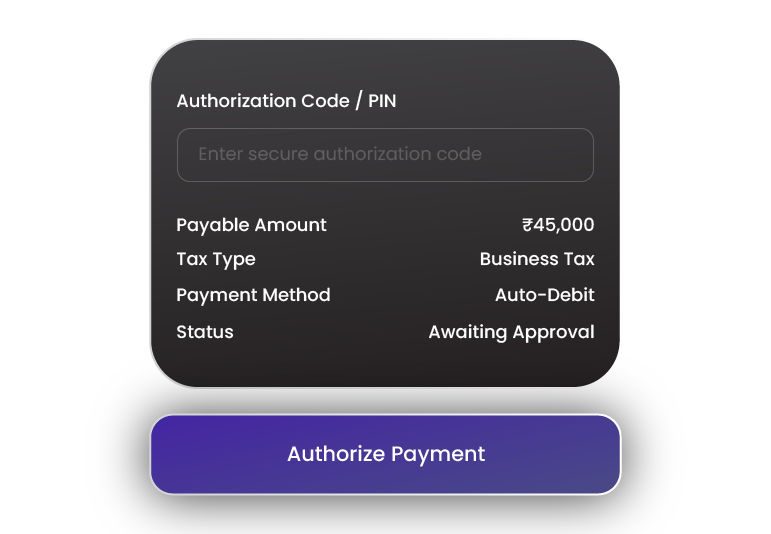

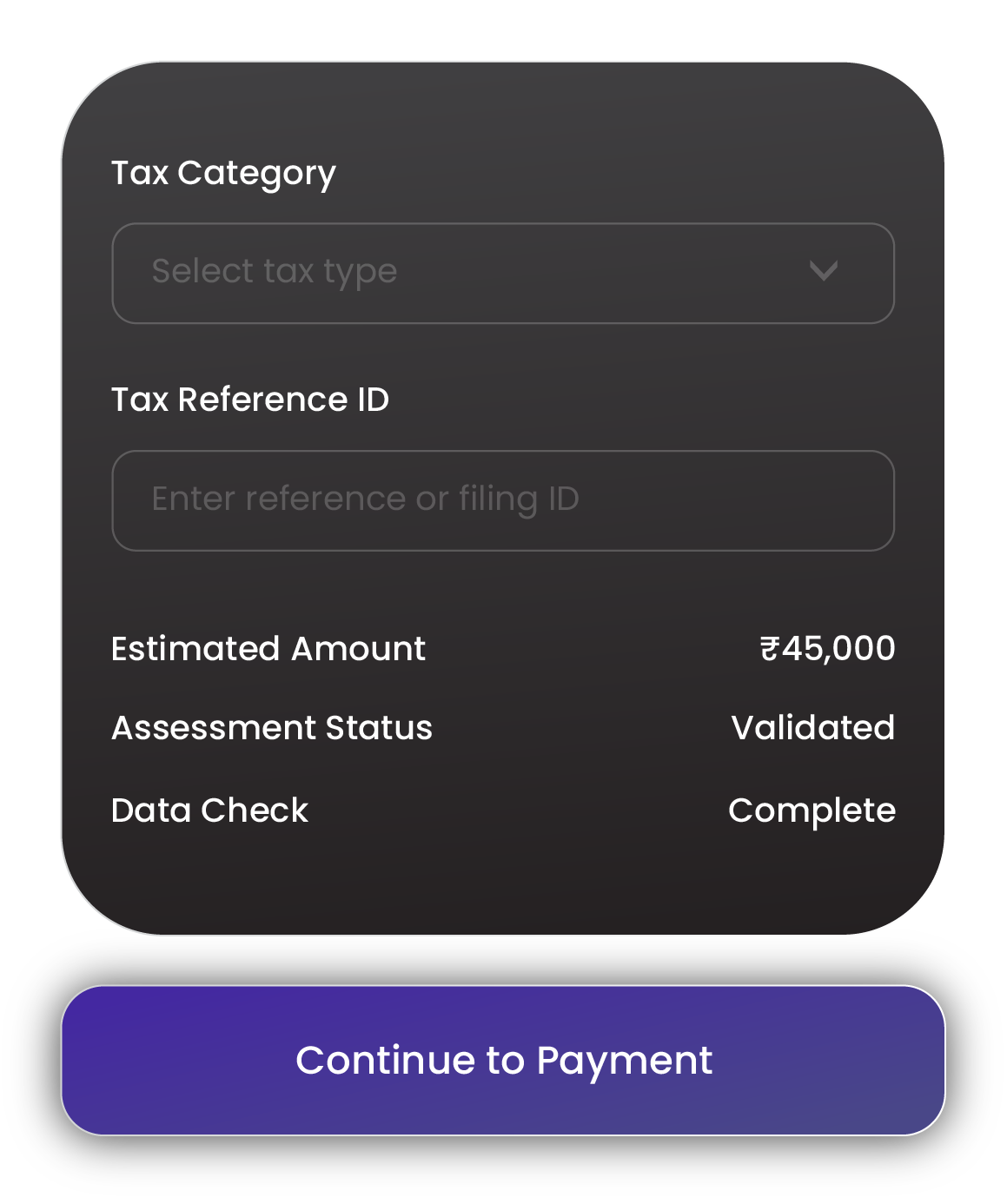

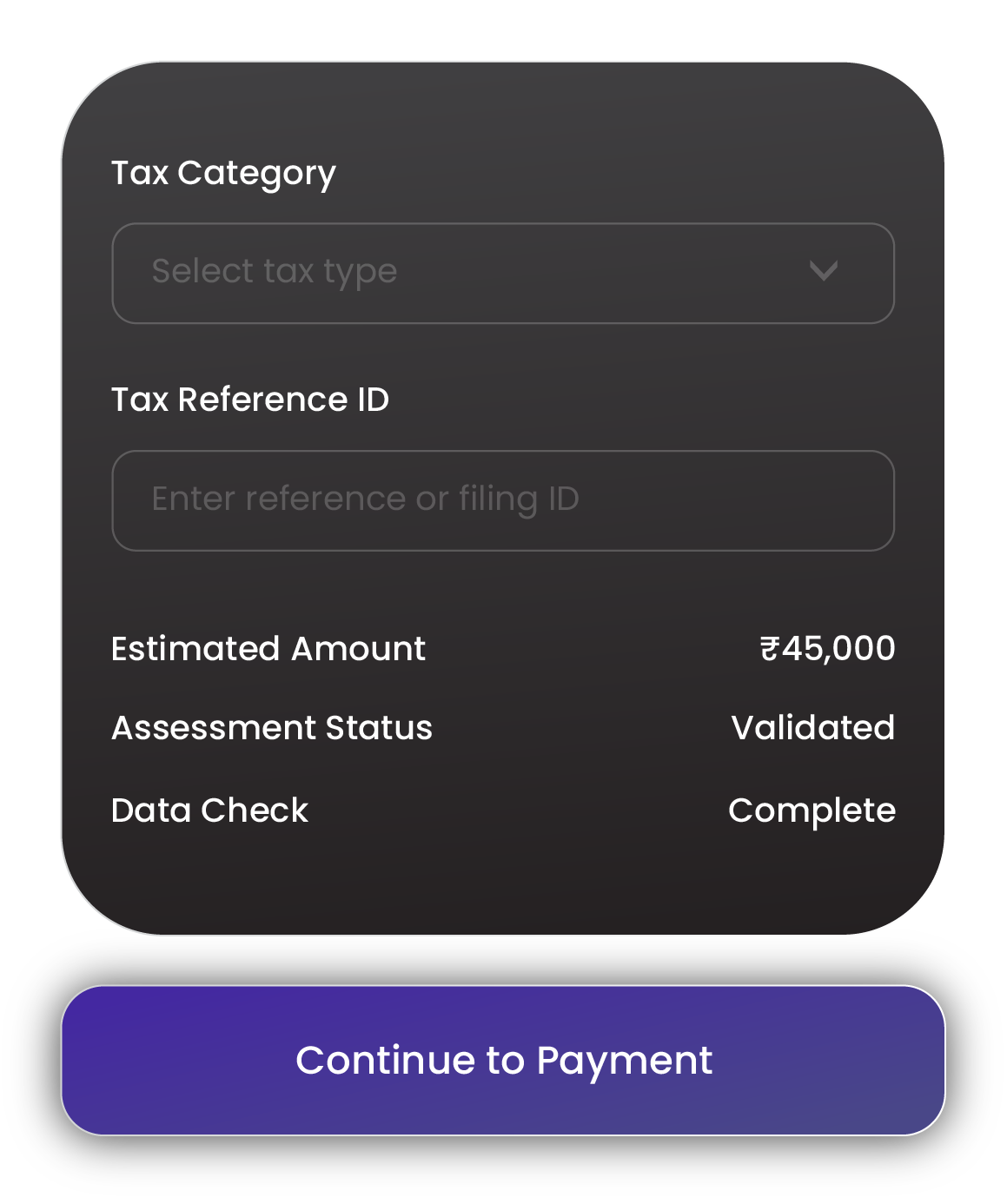

You start by selecting the tax category, gathering essential information, validating accuracy, and ensuring details align with obligations before confidently moving into the payment stage.

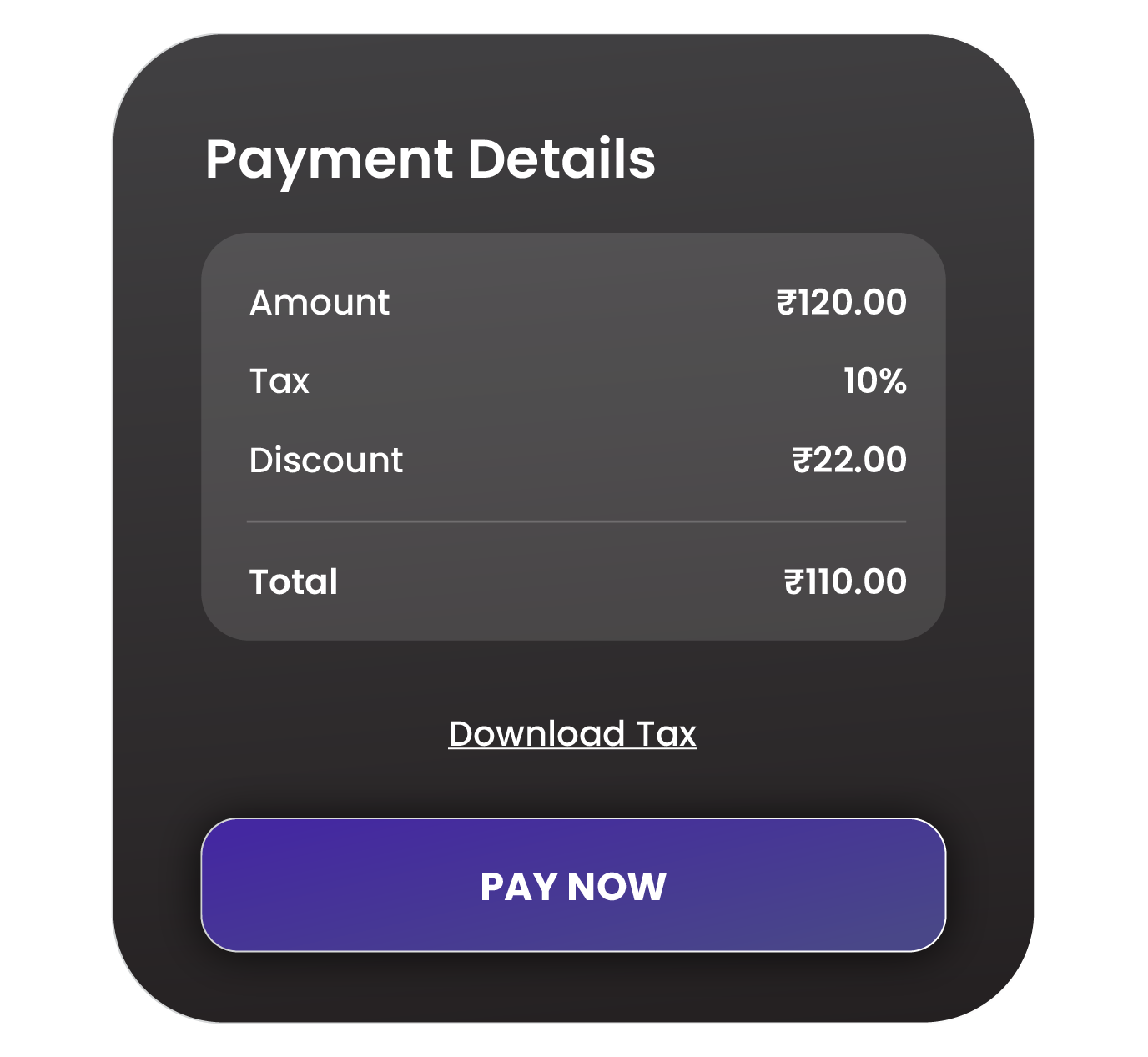

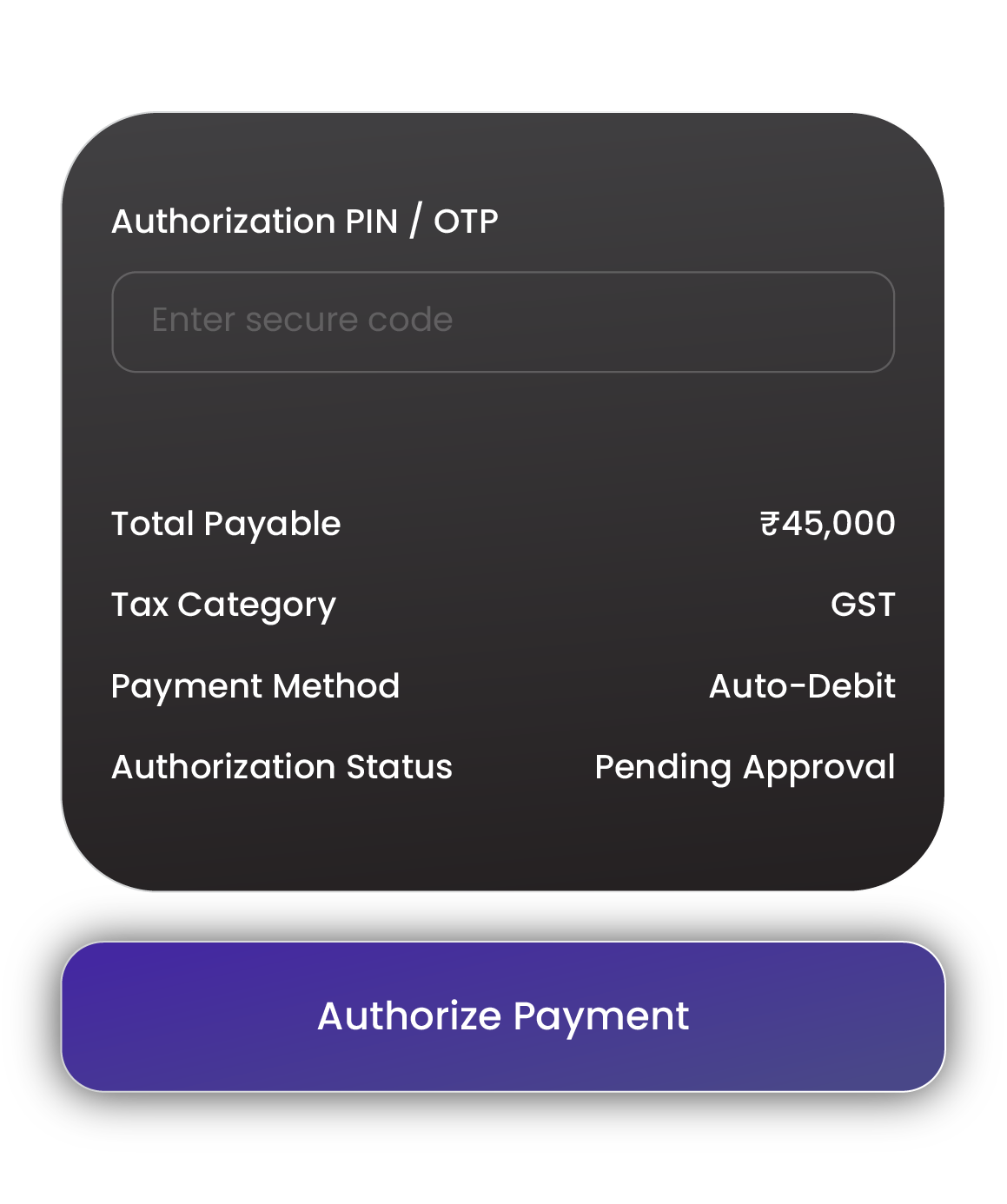

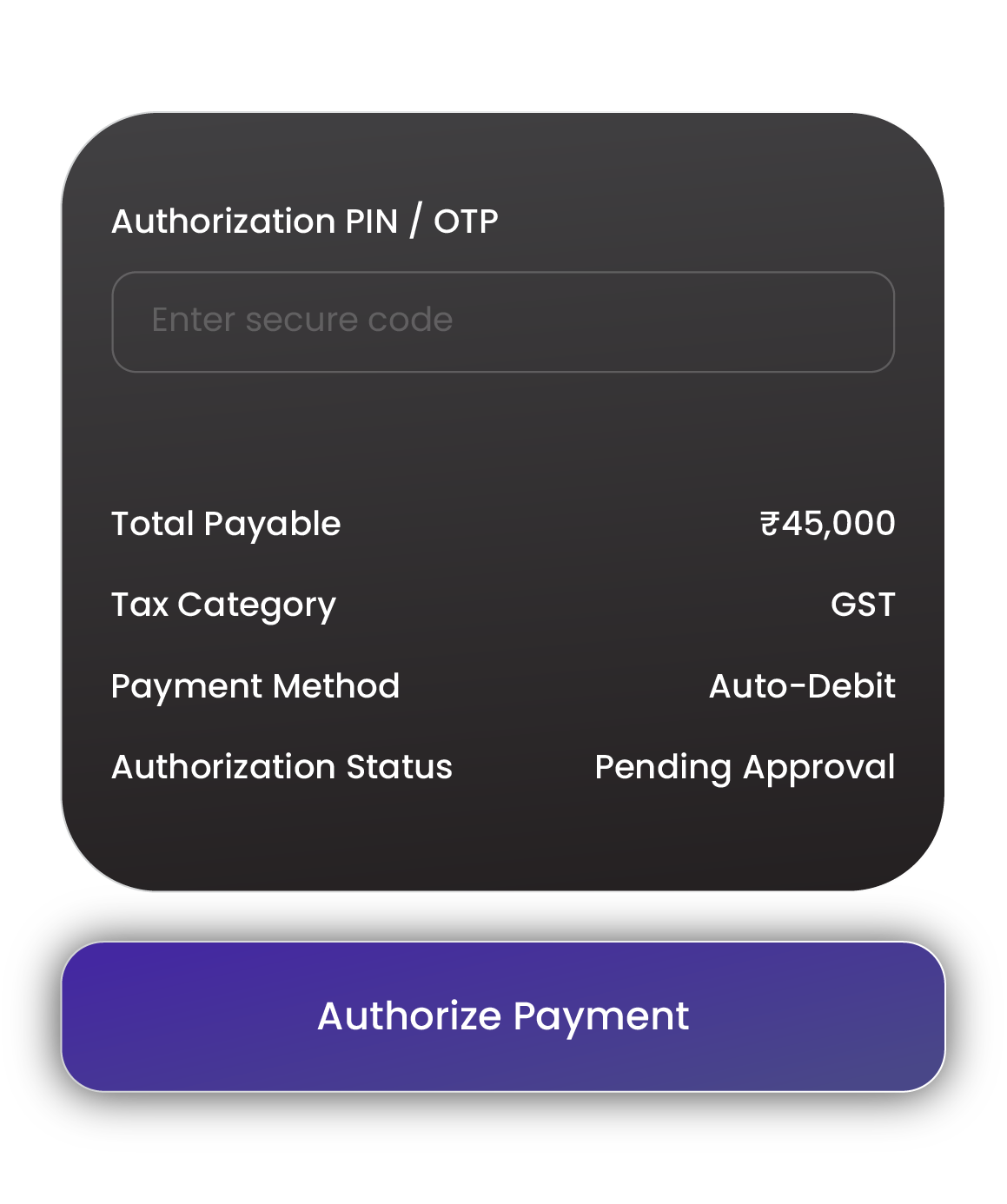

You review calculated dues, confirm accuracy, authenticate required credentials, and approve the payment request, ensuring each action proceeds securely and aligns with mandated financial responsibilities.

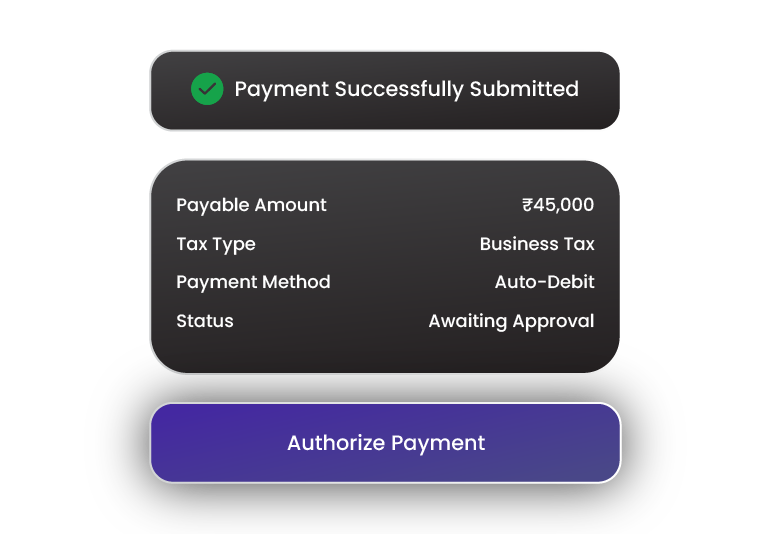

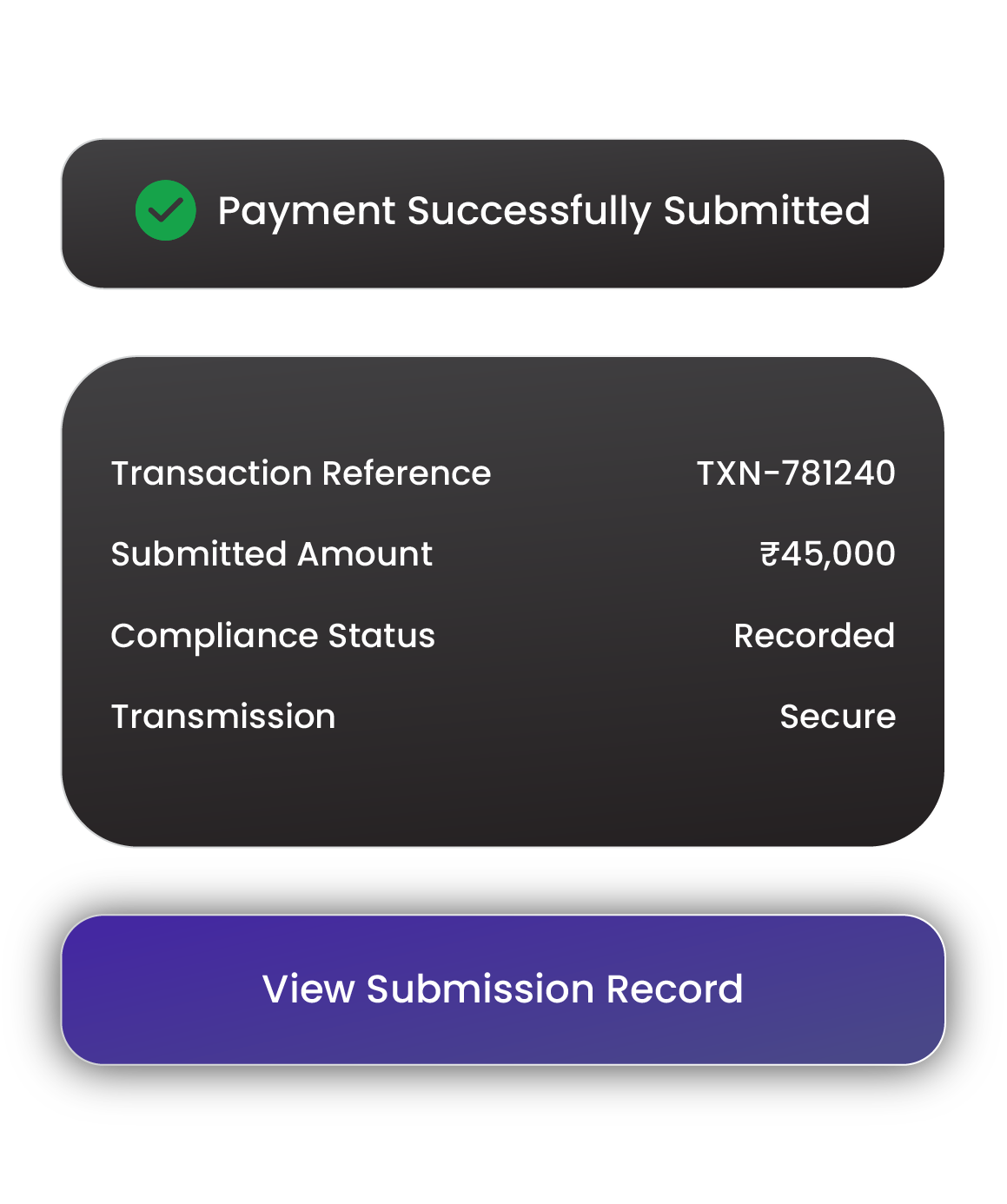

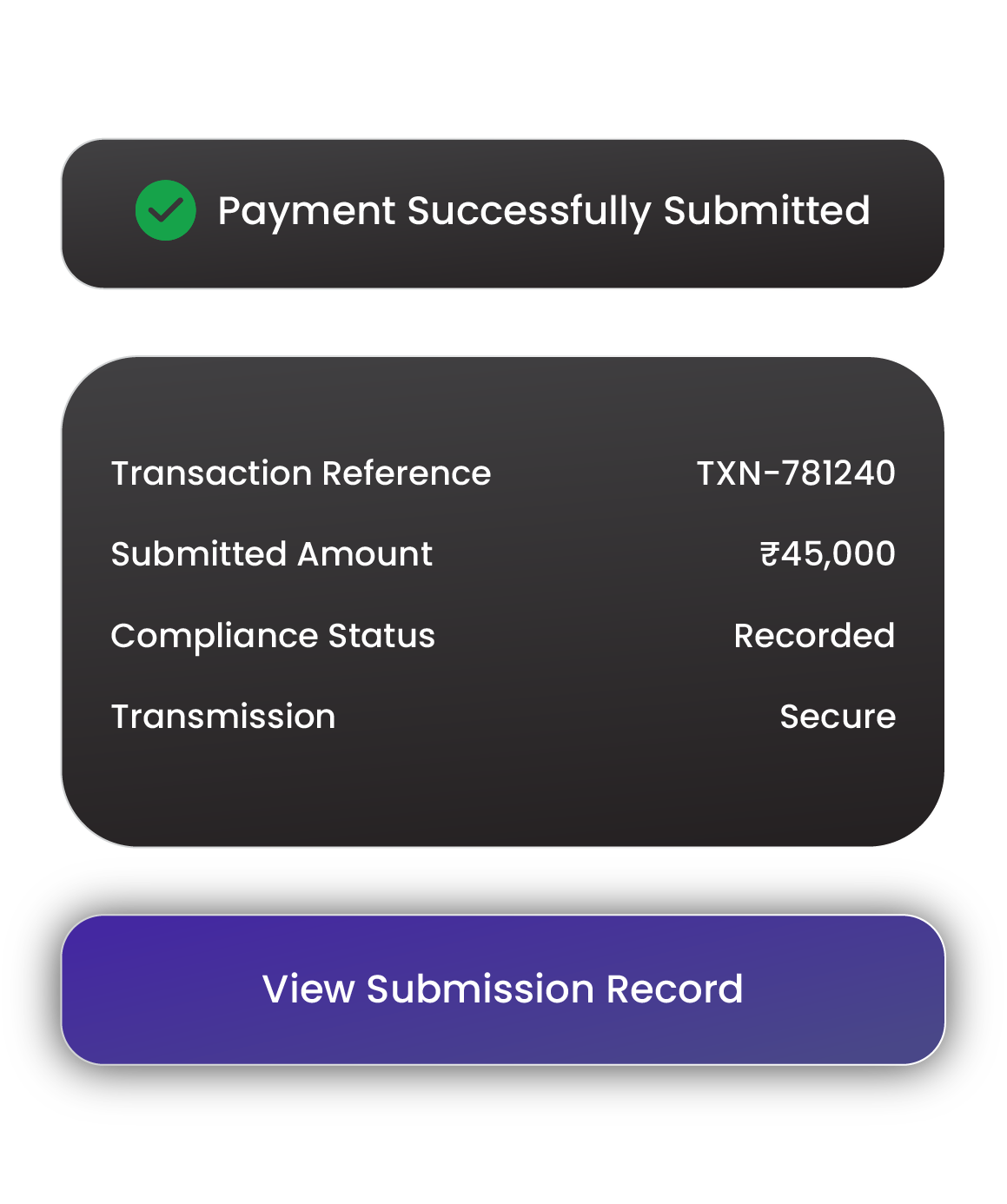

Your authorized tax payment moves through a compliant pathway, recorded accurately, transmitted securely, and finalized reliably so obligations are fulfilled smoothly without delays or complications.

Discover Various Digital Tax Payment Options

Explore multiple tax categories the platform supports, allowing individuals and businesses to complete essential payments through secure, reliable, trusted pathways.

Validated workflows process TDS liabilities accurately, ensuring execution and consistent regulatory alignment.

Key Characteristics Defining Efficient Tax Payments

Our tax payment features offer structured processes, guided inputs, verified steps ensuring every submission stays dependable, consistent, and clearly organized.

Structured steps help users easily enter tax details with clarity, accuracy, confidence, and smooth progress throughout the process.

Users follow an intuitive flow, greatly reducing confusion, speeding completion, and keeping all tax payment steps manageable.

Information undergoes confirmation checks that uphold correctness, reduce errors, and provide assurance throughout payments processing.

Submissions follow protected pathways, maintaining confidentiality, strengthening data integrity, and supporting safe obligation completion.

Documented confirmations provide visibility, support compliance, and ensure completed payments remain traceable within financial records.

Payments move through monitored systems ensuring consistency, preventing disruptions, and supporting reliable outcomes across submissions.